Accounting practices united states of america pdf

(1993) International accounting harmonisation in developed stock market countries: an empirical comparative study of measurement and associated disclosure practices in France, Germany, Japan, United Kingdom, and the United States of America.

development of GAAP in the United States. Although the responsibility for setting accounting standards Although the responsibility for setting accounting standards now rests with the FASB, the Securities and Exchange Commission (SEC), the Governmental

In 1973, leading professional accountancy bodies from Australia, Canada, France, Germany, Japan, Mexico, Netherlands, United Kingdom and the United States of America established the International

united states of america before the securities and exchange commission securities exchange act of 1934 release no. 82206 / december 4, 2017 accounting and auditing enforcement

UNITED STATES OF AMERICA FEDERAL ENERGY REGULATORY COMMISSION 18 CFR Parts 35, 101, 154, 201, 346, and 352 Docket No. RM02-7-000, Order No. 631 Accounting, Financial Reporting, and Rate Filing Requirements for Asset Retirement Obligations (Issued April 9, 2003)

United States of America in Congress assembled, SECTION 1. regulation of the practice of accounting in the State or States having jurisdiction over a registered public accounting firm or associated person thereof, with respect to the matter in ques-tion. (2) AUDIT.—The term ‘‘audit’’ means an examination of the financial statements of any issuer by an independent public ac

UNITED STATES OF AMERICA FEDERAL TRADE COMMISSION WASHINGTON, D.C. 20580 Page 1 of 17 February 21, 2014 The Honorable Richard Cordray Director Consumer Financial Protection Bureau

6 Reply Comments of the United States Postal Service Regarding Proposed Methodology for the Allocation of Assets and Liabilities to Competitive Products, November 24, 2009, at 3 …

The United States of America Today. American culture portrays a strong sense of regional and ethnic identity which is represented by a number of subcultures and influenced by the country’s vast geographical and regional differences. America’s influence on business culture and practices across the globe is unmistakable. However, understanding the cultural concepts behind the surface is just

a) The term “United States” means the United States of America, including the States thereof, but does not include the U.S. Territories.Any reference to a “ State ” of the United States …

I Differences between United Kingdom and United States generally accepted accounting principles continued (n) Discontinued operations Under UK GAAP, the disposal of certain lines of business and joint ventures and associates are shown as discontinued

CONSUMER FINANCIAL PROTECTION BUREAU ) and UNITED STATES

United States PwC

Use of standard costs, budgets and performance report variances became popular in the United States prior to World War II. Comparable widespread use of these management accounting practices did not occur in Britain until the 1970s, if then.

1 Agreement between the Government of the United States of America and the Government of the Co-operative Republic of Guyana to Improve International Tax

UNITED STATES OF AMERICA Before the SECURITIES AND EXCHANGE COMMISSION SECURITIES EXCHANGE ACT OF 1934 Release No. 84562 / November 9, 2018 ACCOUNTING AND AUDITING ENFORCEMENT Release No. 3993 / November 9, 2018 ADMINISTRATIVE PROCEEDING File No. 3-18891 In the Matter of Pyxus International, Inc. Respondent. ORDER INSTITUTING …

Keywords: Management accounting practices, management tools and techniques in the United States, Certified Management Accountants, strategic management accounting practices, gap between theory and practice of management accounting practices

A Brief History of Auditing in the United States Although auditing procedures have been relied upon for many years, the formal practice of auditing has been in existence for a relatively short period.

Audit and Accounting Guidelines, which summarizes the accounting practices of specific industries (e.g. casinos, colleges, airlines, etc.) and provides specific …

Austrade can help you to reduce the time, cost and risk of exporting to United States of America. Valuable information and advice on doing business in United States of America. Find out about business risks, tariffs and regulations, and taxation in United States of America.

A Study of Cost Accounting Practices – Through Germany, Japan, and the United States Su, Chao LU BUSN68 20131 Department of Business Administration

It seeks to explain the differences in labour control practices between the two regions and to discuss the impact on these practices of accounting and other quantitative techniques c.1760-1870. In particular, it aims to consider the central role played by government in the process.

For example, companies in the United States are allowed to use last in, first out, or LIFO, as an inventory-costing method, which is a practice banned in most other countries.

In response to the Enron accounting scandal, the Sarbanes-Oxley Act of 2002, Pub. L. 107-204, 116 Stat. 745 (2002) created the Public Company Accounting Oversight Board (PCAOB) and gave it authority to establish auditing standards for public companies registered with the SEC.

The general principles of constitutional law in the United States of America by Andrew Cunningham McLaughlin and Thomas McIntyre Cooley File Type : Online

United States – Life Insurance Definition Accounting Taxation More than half of the company’s business is issuing insurance or annuity contracts or

The Impact of Accounting Practices on the Measurement of Net Income and Shareholders’ Equity: Latin American Versus the United States

in the united states district court . western district of pennsylvania . consumer financial protection bureau ) and united states of america, ) ) plaintiffs, ) civil action no.

the Public Company Accounting Oversight Board in the United States of America on the Transfer of Certain Personal Data I- DEFEVITIONS 1. For the purpose of this Agreement: (a) ”personal data” means any infonnation relating to an identified or identifiable natural person {‘data subject’); an identifiable person is one who can be identified, directly or indirectly, in particular by reference to

accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The impact of the accounting differences between Canadian GAAP and U.S. GAAP on the company’s balance sheets at

The History of American Government Accounting Reform INTRODUCTION The founding political philosophy and constitutional principles of government accountability in the United States, largely unchanged in the past two hundred and thirty years, have served as the guiding light for the development of government accounting. At the beginning of the 20th century, during the Progressive Era in …

Russia, Spain, Turkey, the United Kingdom and the United States – found a strong deterioration in public trust in government between 2001 and 2005 in all but a few of the countries.

This legislation required internal accounting controls instituted by executives at businesses, accounting firms and consultancies based in the United States. Sarbanes-Oxley is designed to eliminate accounting tricks and discourage disconnects between executives and accountants that caused the controversies.

united states of america n e s w me vt nh ma ri ct nj md de dc ny pa va nc sc ga fl wv oh tn ky ms al la ar mo ok tx ks ne ia nd sd mn wi mi il in mt wy ut co nv az nm ca id or wa ak hi me fl vt mn nh ia ma mo ri ar ct la ny nd pa sd nj ne de ks dc ok md tx va mt wv id oh wy mi ut wi co il az in nm ky wa tn or nc nv sc ca ms ak al hi ga me fl vt mn nh ia ma mo ri ar ct la ny nd pa sd nj ne de

accounting practices in the industry, could severely reduce the comparability of financial statements among jurisdictional entities and make review of existing rates more difficult. 9.

Government Auditing Standards issued by the comptroller general of the United States, or rules and regulations promulgated by the U.S. Securities and Exchange Commission. [Footnote renumbered by

the accounting practices and principles that the PRC has determined will govern the operation of the Competitive Products Fund (CPF) and the determination of the assumed federal income tax to be transferred from the CPF to the existing Postal Service Fund (PSF).

united states of america before the securities and exchange commission securities exchange act of 1934 release no. 84781 / december 11, 2018 accounting and auditing enforcement

The CGMA Designation and the Practice of Public Accounting

management accounting practices, management tools and techniques in the United States, strategic management accounting practices, gap between theory and practice of management accounting practices.

The United States Public Company Accounting Reform and Investor Protection Act of 2002 — also called the Sarbanes-Oxley Act of 2002 (named after its Congressional cosponsors, Senator Paul Sarbanes and Congressman Michael Oxley) — is mandatory legislation requiring major changes to the regulation of financial practice and corporate governance.

The International Accounting Standards Committee (IASC) was formed in 1973 through an agreement made by professional accountancy bodies from Australia, Canada, France, Germany, Japan, Mexico, the Netherlands, the United Kingdom and Ireland, and the United States of America.

Principles and practices in the 21st century A1457 Kimberly A. Zeuli and Robert Cropp . C OOPERATIVES: ABOUT THE COVER IMAGE: The “twin pines”is a familiar symbol for cooperatives in the United States.The Cooperative League of the USA, which eventually became the National Cooperative Business Association (NCBA), adopted it as their logo in 1922.The pine tree is an …

ments that both in the United States and elsewhere investors incorporate analysts’ earnings forecasts in their firm valuations and respond to revisions in those forecasts, (e.g., Capstaff, Paudyal, and Rees [2000], Bercel [1994]).

If you’re interested in studying in the United States and joining the growing ranks of accounting and business students, the first step in beginning your journey is to pick a level and a program of study, be it a bachelor’s, master’s, or other degree, and what

This objective of this paper is to compare the accounting standards in Nigeria, United States of America and United kingdom. Reasons For Accounting Regulation And Standards. Academics and researchers are in a unanimous agreement that financial reporting practice of a country depends on several factors that include the legal, economic, cultural and historical background of a country. …

United Statesfl (Carey 1969, 44). Scottish and English Chartered Accountants, who settled in the United States during the last quarter of the 19th century to report on British interests, performed much of the early auditing work.

Generally Accepted Accounting Principles (United States) Generally Accepted Accounting Principles ( GAAP or U.S. GAAP ) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). – nickel and dimed on not getting by in america pdf The CGMA Designation and the Practice of Public Accounting in the United States The CGMA designation identifies management accountants, who combine accounting …

This article compares cost center practices under Grenzplankostenrechnung (GPK), a common approach to cost accounting in Germany, and typical cost center practices in the United States. Differences between Germany and the United States on Hofstede’s uncertainty avoidance dimension and in workforce and management education provide possible explanations for differences in the …

Doing business in the United States This booklet is designed to provide an overview of the business climate in the United States. The discussion surveys the many considerations involved in establishing a business enterprise in the United States. While every attempt is made to keep this publication current and concise, the rapidity of change and the complexity of our interrelated world is a

United States . At all relevant times, 0+5¶VV WRFN wa s registered with the Commiss ion pursuant to At all relevant times, 0+5¶VV WRFN wa s registered with the Commiss ion pursuant to Section 12( b) of the Exchange Act and trade d on the New York Stock Exchange ( ³NYSE ´).

Show transcribed image text Accounting practice in the United States follows the generally accepted accounting principles (GAAP) developed by the Financial Accounting Standards Board (FASB), which is a nongovernmental, professional standards body that monitors accounting practices and evaluates controversial issues.

united states of america before the securities and exchange commission securities exchange act of 1934 release no. 82556 / january 22, 2018 accounting and auditing enforcement release no. 3918 / january 22, 2018 administrative proceeding file no. 3-18346 in the matter of cynthia holder , cpa, jeffrey wada, cpa, david middendorf, cpa, thomas whittle, cpa, and david britt , cpa respondent s

United States, where United States of America accounting framework for fundraising is taken as an example of a successful fundraising background. Comparison of this two accounting frameworks leads to the conclusion and proposal for the implementation of the accounting framework for fundraising in Croatia, with the aim of developing this type of financial support for private HEIs. Keywords

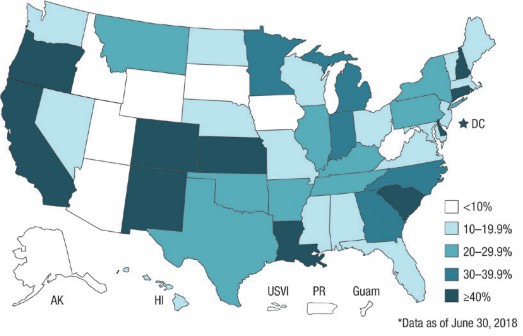

United States General Accounting Office GAO Report to the Honorable Tom Harkin, Ranking Minority Member, Committee on Agriculture, Nutrition, and Forestry, U.S. Senate July 1999 ANIMAL AGRICULTURE Waste Management Practices GAO/RCED-99-205. GAO United States General Accounting Office Washington, D.C. 20548 Resources, Community, and Economic Development …

For the United States of America’s governmental sector, recruitment and selection practices from the “Recruitment and Selection Best Practices Guide”, developed for use by the Department of Veterans Affairs (Department of Veterans Affairs, 2012) were compiled.

Animal agriculture waste management practices. United

A Comparison of Accounting Practices of the United States and Mexico . By Kenya Watts. Get PDF (894 KB) Abstract. With increased globalization the need for more harmonious accounting principles intensifies. Since hope to spend some time working as an accountant in Mexico, he purpose of this project was to acquaint myself with the structure of Mexico’s accounting body. I set out to learn and

Accounting Principles and Practices for The Operation of

History of Accounting in America Bizfluent

Tchanges that collectively brought the profession to its

UNITED STATES OF AMERICA FEDERAL TRADE COMMISSION

A Comparison of Accounting Practices of the United States

Studying in the United States A Guide for ACCA Members

Postal Regulatory Commission UNITED STATES OF AMERICA

– The United States of America Communicaid

United States Auditing Standards Accounting Research

International accounting harmonisation in developed stock

Accounting Framework for Fundraising as a Source of

DIFFERENCES BETWEEN CANADIAN AND UNITED STATES OF AMERICA

The CGMA Designation and the Practice of Public Accounting

United States . At all relevant times, 0 5¶VV WRFN wa s registered with the Commiss ion pursuant to At all relevant times, 0 5¶VV WRFN wa s registered with the Commiss ion pursuant to Section 12( b) of the Exchange Act and trade d on the New York Stock Exchange ( ³NYSE ´).

The History of American Government Accounting Reform INTRODUCTION The founding political philosophy and constitutional principles of government accountability in the United States, largely unchanged in the past two hundred and thirty years, have served as the guiding light for the development of government accounting. At the beginning of the 20th century, during the Progressive Era in …

the accounting practices and principles that the PRC has determined will govern the operation of the Competitive Products Fund (CPF) and the determination of the assumed federal income tax to be transferred from the CPF to the existing Postal Service Fund (PSF).

For the United States of America’s governmental sector, recruitment and selection practices from the “Recruitment and Selection Best Practices Guide”, developed for use by the Department of Veterans Affairs (Department of Veterans Affairs, 2012) were compiled.

Keywords: Management accounting practices, management tools and techniques in the United States, Certified Management Accountants, strategic management accounting practices, gap between theory and practice of management accounting practices

development of GAAP in the United States. Although the responsibility for setting accounting standards Although the responsibility for setting accounting standards now rests with the FASB, the Securities and Exchange Commission (SEC), the Governmental

United States, where United States of America accounting framework for fundraising is taken as an example of a successful fundraising background. Comparison of this two accounting frameworks leads to the conclusion and proposal for the implementation of the accounting framework for fundraising in Croatia, with the aim of developing this type of financial support for private HEIs. Keywords

DIFFERENCES BETWEEN CANADIAN AND UNITED STATES OF AMERICA

A Study of Cost Accounting Practices Through Germany

United States of America in Congress assembled, SECTION 1. regulation of the practice of accounting in the State or States having jurisdiction over a registered public accounting firm or associated person thereof, with respect to the matter in ques-tion. (2) AUDIT.—The term ‘‘audit’’ means an examination of the financial statements of any issuer by an independent public ac

(1993) International accounting harmonisation in developed stock market countries: an empirical comparative study of measurement and associated disclosure practices in France, Germany, Japan, United Kingdom, and the United States of America.

For the United States of America’s governmental sector, recruitment and selection practices from the “Recruitment and Selection Best Practices Guide”, developed for use by the Department of Veterans Affairs (Department of Veterans Affairs, 2012) were compiled.

management accounting practices, management tools and techniques in the United States, strategic management accounting practices, gap between theory and practice of management accounting practices.

united states of america before the securities and exchange commission securities exchange act of 1934 release no. 82556 / january 22, 2018 accounting and auditing enforcement release no. 3918 / january 22, 2018 administrative proceeding file no. 3-18346 in the matter of cynthia holder , cpa, jeffrey wada, cpa, david middendorf, cpa, thomas whittle, cpa, and david britt , cpa respondent s

accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The impact of the accounting differences between Canadian GAAP and U.S. GAAP on the company’s balance sheets at

This objective of this paper is to compare the accounting standards in Nigeria, United States of America and United kingdom. Reasons For Accounting Regulation And Standards. Academics and researchers are in a unanimous agreement that financial reporting practice of a country depends on several factors that include the legal, economic, cultural and historical background of a country. …

accounting practices in the industry, could severely reduce the comparability of financial statements among jurisdictional entities and make review of existing rates more difficult. 9.

Keywords: Management accounting practices, management tools and techniques in the United States, Certified Management Accountants, strategic management accounting practices, gap between theory and practice of management accounting practices

UNITED STATES OF AMERICA FEDERAL TRADE COMMISSION WASHINGTON, D.C. 20580 Page 1 of 17 February 21, 2014 The Honorable Richard Cordray Director Consumer Financial Protection Bureau

Austrade can help you to reduce the time, cost and risk of exporting to United States of America. Valuable information and advice on doing business in United States of America. Find out about business risks, tariffs and regulations, and taxation in United States of America.

It seeks to explain the differences in labour control practices between the two regions and to discuss the impact on these practices of accounting and other quantitative techniques c.1760-1870. In particular, it aims to consider the central role played by government in the process.

development of GAAP in the United States. Although the responsibility for setting accounting standards Although the responsibility for setting accounting standards now rests with the FASB, the Securities and Exchange Commission (SEC), the Governmental

The CGMA Designation and the Practice of Public Accounting in the United States The CGMA designation identifies management accountants, who combine accounting …

Doing business in the United States This booklet is designed to provide an overview of the business climate in the United States. The discussion surveys the many considerations involved in establishing a business enterprise in the United States. While every attempt is made to keep this publication current and concise, the rapidity of change and the complexity of our interrelated world is a

International accounting harmonisation in developed stock

Disclosure Practices Enforcement of Accounting Standards

Principles and practices in the 21st century A1457 Kimberly A. Zeuli and Robert Cropp . C OOPERATIVES: ABOUT THE COVER IMAGE: The “twin pines”is a familiar symbol for cooperatives in the United States.The Cooperative League of the USA, which eventually became the National Cooperative Business Association (NCBA), adopted it as their logo in 1922.The pine tree is an …

The International Accounting Standards Committee (IASC) was formed in 1973 through an agreement made by professional accountancy bodies from Australia, Canada, France, Germany, Japan, Mexico, the Netherlands, the United Kingdom and Ireland, and the United States of America.

I Differences between United Kingdom and United States generally accepted accounting principles continued (n) Discontinued operations Under UK GAAP, the disposal of certain lines of business and joint ventures and associates are shown as discontinued

In response to the Enron accounting scandal, the Sarbanes-Oxley Act of 2002, Pub. L. 107-204, 116 Stat. 745 (2002) created the Public Company Accounting Oversight Board (PCAOB) and gave it authority to establish auditing standards for public companies registered with the SEC.

International Accounting Standards Committee (IASC)

United States Auditing Standards Accounting Research

The History of American Government Accounting Reform INTRODUCTION The founding political philosophy and constitutional principles of government accountability in the United States, largely unchanged in the past two hundred and thirty years, have served as the guiding light for the development of government accounting. At the beginning of the 20th century, during the Progressive Era in …

UNITED STATES OF AMERICA FEDERAL ENERGY REGULATORY COMMISSION 18 CFR Parts 35, 101, 154, 201, 346, and 352 Docket No. RM02-7-000, Order No. 631 Accounting, Financial Reporting, and Rate Filing Requirements for Asset Retirement Obligations (Issued April 9, 2003)

The CGMA Designation and the Practice of Public Accounting in the United States The CGMA designation identifies management accountants, who combine accounting …

Keywords: Management accounting practices, management tools and techniques in the United States, Certified Management Accountants, strategic management accounting practices, gap between theory and practice of management accounting practices

For the United States of America’s governmental sector, recruitment and selection practices from the “Recruitment and Selection Best Practices Guide”, developed for use by the Department of Veterans Affairs (Department of Veterans Affairs, 2012) were compiled.

UNITED STATES OF AMERICA Before the SECURITIES AND EXCHANGE COMMISSION SECURITIES EXCHANGE ACT OF 1934 Release No. 84562 / November 9, 2018 ACCOUNTING AND AUDITING ENFORCEMENT Release No. 3993 / November 9, 2018 ADMINISTRATIVE PROCEEDING File No. 3-18891 In the Matter of Pyxus International, Inc. Respondent. ORDER INSTITUTING …

the accounting practices and principles that the PRC has determined will govern the operation of the Competitive Products Fund (CPF) and the determination of the assumed federal income tax to be transferred from the CPF to the existing Postal Service Fund (PSF).

United Statesfl (Carey 1969, 44). Scottish and English Chartered Accountants, who settled in the United States during the last quarter of the 19th century to report on British interests, performed much of the early auditing work.

a) The term “United States” means the United States of America, including the States thereof, but does not include the U.S. Territories.Any reference to a “ State ” of the United States …

in the united states district court . western district of pennsylvania . consumer financial protection bureau ) and united states of america, ) ) plaintiffs, ) civil action no.

Agreement Between The Government Of The United States Of

ments that both in the United States and elsewhere investors incorporate analysts’ earnings forecasts in their firm valuations and respond to revisions in those forecasts, (e.g., Capstaff, Paudyal, and Rees [2000], Bercel [1994]).

UNITED STATES OF AMERICA FEDERAL ENERGY REGULATORY COMMISSION

It seeks to explain the differences in labour control practices between the two regions and to discuss the impact on these practices of accounting and other quantitative techniques c.1760-1870. In particular, it aims to consider the central role played by government in the process.

Tchanges that collectively brought the profession to its

The CGMA Designation and the Practice of Public Accounting

Disclosure Practices Enforcement of Accounting Standards

I Differences between United Kingdom and United States generally accepted accounting principles continued (n) Discontinued operations Under UK GAAP, the disposal of certain lines of business and joint ventures and associates are shown as discontinued

Management accounting and the workplace in the United

A Study of Cost Accounting Practices Through Germany

The Impact of Accounting Practices on the Measurement of

UNITED STATES OF AMERICA FEDERAL TRADE COMMISSION WASHINGTON, D.C. 20580 Page 1 of 17 February 21, 2014 The Honorable Richard Cordray Director Consumer Financial Protection Bureau

History of Accounting in America Bizfluent

The CGMA Designation and the Practice of Public Accounting in the United States The CGMA designation identifies management accountants, who combine accounting …

UNITED STATES OF AMERICA FEDERAL TRADE COMMISSION

A Comparison of Accounting Practices of the United States