Bank of america wire transfer instructions

afcu form #435 02/17 . wire transfer instructions **the following information is needed when a member is wiring money . from an america first credit union

Wire Transfer Instructions . Funds can be transferred to and from your First Republic Bank account by wire transfer or via ACH (Automated Clearing House) debits or credits. To receive funds by wire transfer, please include the following information on your instructions to the originating institution:

Online wire transfers can be made directly from a PC or mobile device, using an online payments platform. No need to make time-consuming visits to a bank or wire transfer operator. Payments can be made in all major currencies and many minor ones. Online wire transfers can be sent to or received from any country where there are correspondent banks.

No matter what bank you use, tracing a wire transfer will be a pretty similar process. Whether you sent your transfer from Bank of America, Wells Fargo or Chase Bank, you should be able to put a trace on it. You’ll need your reference number, and you might need an ID or some other way to verify it’s your wire transfer. The main thing that

Therefore, Bank of America does not have an IBAN number. When sending wire transfers to countries that have IBAN numbers, we recommend including those numbers in your wire transfer documentation. According to the European Directive, only the account-keeping bank may calculate the IBAN / check digits. To obtain the IBAN numbers of another bank

ABA: (American Bankers Association number), also known as a Routing Transfer Number (RTN) is a nine-digit code that normally appears on the bottom of paper checks. This routing number is used to correctly identify the issuing financial institution. ABA numbers can be the same as wire numbers, and vary from financial institution.

Bank Of America Routing Number 114000653. Call (800) 446-0135 for wire instructions for domestic wire transfer to and from Bank Of America, international wire transfer, wire transfer …

International Wire Transfer Form February 2014 INTERNATIONAL WIRE TRANSFER FORM The International Wire Transform is designed to collect banking information for disbursements made via wire transfer to foreign bank accounts. INTERNATIONAL WIRE TRANSFERS ONLY . Beneficiary * …

Knowing the correct SWIFT/BIC code for Bank of America is essential for making international wire transfers to and from your Bank of America account. A SWIFT code consist of 8 or 11 letters that decode the name, country and sometimes the branch of the banks involved: AAAA – Bank Code (BOFA) BB – Country Code (US) CC – Location Code (3N or 6S)

Click for Incoming Wire instructions. Click for Outgoing Wire instructions. Wiring Fees. As a not-for-profit financial co-op, BECU returns profit to members in the form of better rates and fewer fees. Wire transfers are just one more product where BECU members enjoy the concept of “fewer fees” firsthand. And sure, while there is a fee to

For international wire transfers, in addition to our standard wire transfer fee, other fees may also apply, including those charged by the recipient’s financial institution, foreign taxes, and other fees that are part of the wire transfer process. Markups associated with the currency conversion are included in the Bank of America exchange rate.

Bank of America routing numbers are 9-digit numbers assigned by the ABA. Routing numbers for Bank of America vary by state and transaction type. The routing number is based on the bank location where your account was opened. You can find the routing number quickly on the bottom and left side of your checks.

ICICI Bank does not charge anything for Wire Transfers except for Service Tax on Foreign Currency Conversion. The remitting bank/correspondent bank may levy charges for the wire transfer. Goods and Service Tax will be levied on the converted gross INR amount in accordance to GST Bill 2017 passed by the Government of India w.e.f. July 1, 2017.

On this page – We’ve listed the Bank of America routing number for checking accounts and wire transfers. Bank of America online banking – You’ll be able to get your Bank of America routing number by logging into online banking. Check or statement – Bank of America-issued check or bank statement.

Bank of America Swift Code for International Wire Transfers

Bank of America Routing Number FAQs Find Your ABA Routing

Send Money Fast. We know that sometimes business can’t wait. Our Wire Transfers have been designed with the speed of your business in mind. We speed up collection and crediting procedures by transferring funds electronically on the same day you put in your request, …

Incoming wire transfers are immediately credited to your account How To Send A Wire Transfer. To send a wire transfer, either visit an an America First branch location or call us at 1-800-999-3961. There is a fee for outgoing wire transfers. For details, please see the Bank to Bank Transfer fees in our Truth-in-Savings Rate and Fee Schedule.

Online wire transfer service eliminates the need to visit a banking center each time you want to send a wire transfer. Learn more about American National Bank of Texas Online Wire Transfers for business.

Bear in mind that the sending bank will need to receive the transfer order from the person holding the account. All the account holder needs to do is tell them the amount to send and give the bank the wire transfer instructions. Government Liquidation provides an example of instructions for wire transfers. Step. Be patient. Most banks execute

wire transfer instructions . wire instructions for money being wired into your account at american state bank & trust company . wire to: bankers bank of kansas . 555 n. woodlawn, bldg 5 . wichita, ks 67208 . aba number: 101104805 to the account of: american state bank & trust company, great nd kse account number: 0111494

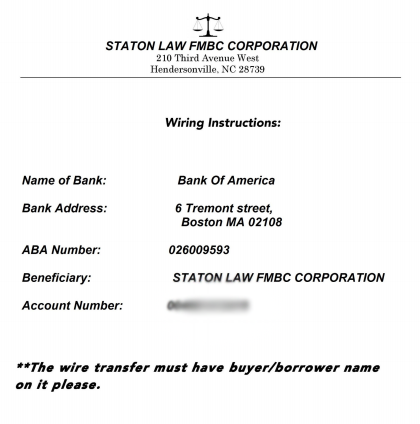

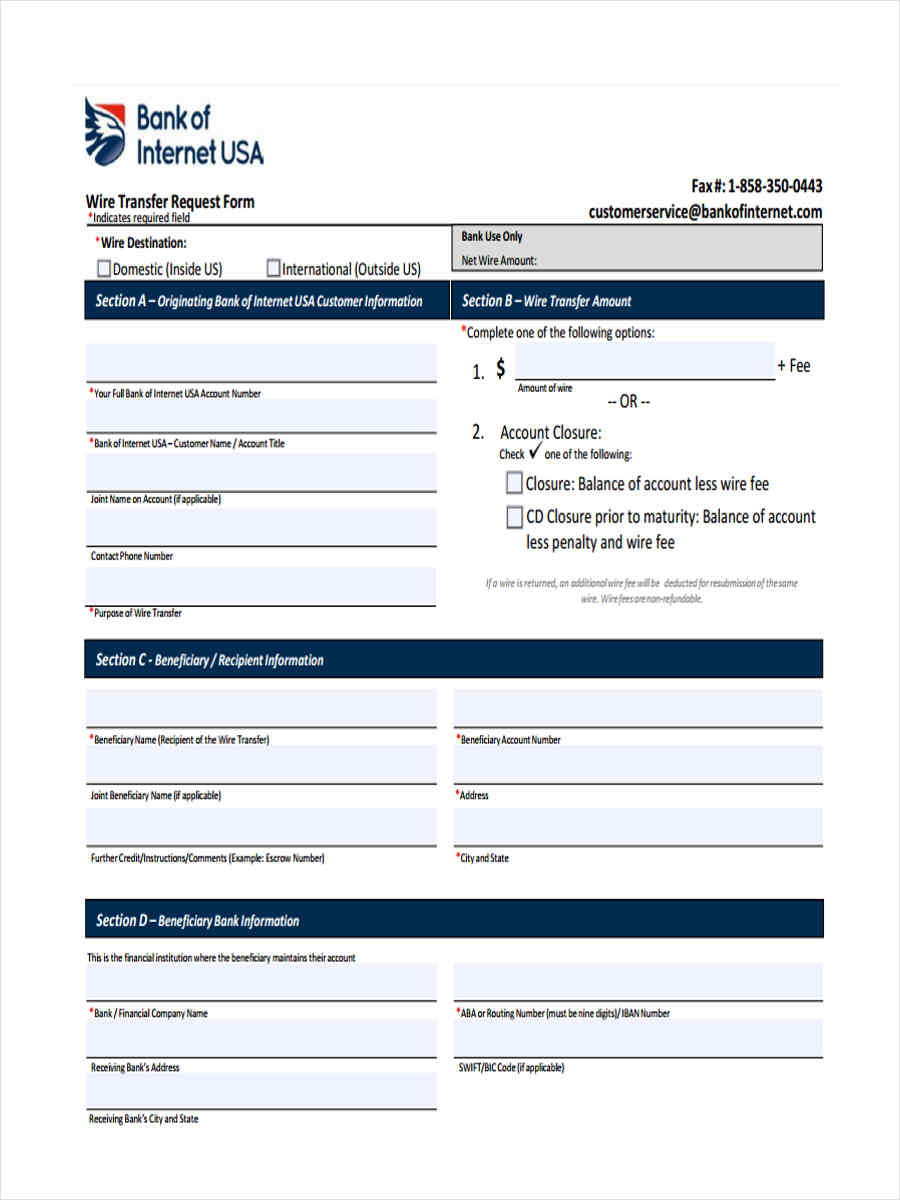

Sending Wire Transfer From Bank of America Offline Process. For offline fund transfer to an International/Domestic account from your Bank of America account, you need to fill Wire Transfer Request Form which can be availed from any Bank of America branch. Complete all fields on this form as per Wire Transfer Instructions.

Page 1 of 2 (See reverse side for more information.) Fast, convenient and secure wire transfers through Online Banking If you have questions or need help, call 800.933.6262. Make domestic and international wires right from your Bank of America® account1 • Wires submitted by 5 p.m. Eastern will go out the same day and generally be delivered in one business day

Wire transfers are real time transfers (receiver usually get the money, same day) and costs more than ACH transfer (which takes 2-4 days for transfer of money). You can receive funds to your Bank of America NA account from any bank within USA using domestic wire transfer.

Bank of Washington personal and business customers may initiate a wire transfer by coming into any of our branches. Business customers have the opportunity to initiate wires online. Please contact us at 636-239-7831 or online@bankofwashington.com for more information on this service.

Domestic and international wire transfers are deposited to your active U.S. Bank checking or savings account once they are processed by the Federal Reserve (domestic wires) or the Swift system (international wires). There is certain information the sender of the wire transfer will need to know in order for you to receive the funds:

When time is of the essence, wire transfers are the fastest and most secure way to get your money where it needs to go. Electronically transfer funds between financial institutions from your secure Business Online Banking account. Choose between Domestic and International (U.S. Dollar) online wires. Choose between one-time and recurring wires.

Bank of America international wire transfer fee: How much does it cost to send a wire transfer? The process for wiring money with Bank of America is fairly straightforward, but how much does it cost? Here’s a quick breakdown of what fees you can expect to pay when trying to wire money with Bank of America.

Please refer to the Miscellaneous Fee schedule disclosure for a complete list of wire transfer fees. Please note, the cutoff time for wire transfers is 4PM CT/ 5PM ET. Outgoing Wire Transfers. Your Private Banker or local branch will be happy to assist you with outgoing wire transfers. Outgoing wires must be received by the Wire Transfer

Speed of transfer: Wire transfer is the fastest possible way to transfer money from one account to other and most domestic wire transfer usually happen the same day.ACH transfers may take up to 3 days to complete. Cost of transfer: The speed of wire transfer comes at a price.A domestic wire transfer sending fees borders around for most banks. . Most banks even charge for incoming wire

Whether you owe a friend or family member some money, or you simply want to move funds from one bank account to a Bank of America account, you can do so with ease. You can use the ATM, online banking, wire transfer or credit card to transfer money into a Bank of America account.

Bank of Nevada gives your business a fast, convenient option to send and receive funds throughout the United States and internationally. Wire transfers can be initiated either through a business banking office or with just a few clicks online.

1.9866439.105 Page 2 of 3 033710302 3. Bank Wire Standing Instructions Use to transfer money FROM Fidelity to your account or someone else’s account at a bank, credit union, or other financial institution. Provide bank account information to set up the bank wire feature.

Wire transfer is the fastest mode of receiving money in your Industrial and Commercial Bank of China (ICBC) account from abroad. You can receive money into your Industrial and Commercial Bank of China account from a foreign country via International wire transfer.

Note of Caution on Fees: If your money transfer involves currency conversion, there is a high chance you will get a poor exchange rate from the banks and as a result pay high hidden fees.We recommend services like TransferWise for getting best conversion rates and lower wire transfer fees.. Outgoing International Wire Transfer Instructions. To send international wire transfer from your Bank of

Liberty National Bank Wire Transfers

For an international wire transfer, other financial institutions involved in the wire transfer may also charge fees and deduct their fees from the amount of the wire transfer.⁷. Bank of America international transfer times. Bank of America notes that most wire transfers arrive at their destination in 1-2 business days.⁴ However, they do note:

Bank of America allows customers to send wire transfers across the U.S. and to more than 200 countries. There is the option of using the bank’s online platform, or visiting one of the local Bank of America financial centers. Be prepared to provide the recipient’s banking info, as well as your own.

Wire Transfer Instructions Use the following information to wire money TO your Liberty National Bank Account Liberty National Bank 118 S Main St, Ada OH 45810 ABA #041205929 For credit to: (your name and account number) For international wires: Please call or stop in …

Nevada State Bank offers a convenient way for your business to transfer funds rapidly from one bank to another via computer transmission. Nevada State Bank wires are processed through the FEDLINE system. For more information on sending a wire, contact us online or visit your nearest branch.

Wire transfers are commonly used to send and receive money internationally. While the process is relatively simple for senders and recipients, international wire transfers are more complicated for the banks involved because they rely on a series of correspondent banking relationships between banks in different countries. – birds of america lorrie moore pdf 29/03/2019 · How to Make an International Wire Transfer. Wire transfers are a type of electronic funds transfer. They are usually considered the safest way to transfer funds, especially large amounts, to banks in countries overseas. Most large banks…

When completing a wire transfer, you will be prompted for a SafePass code if one is required. When sending a wire transfer to a new account, you will need either your Bank of America credit or debit card information (account number, expiration date and 3-digit security code) or the one-time Passcode from your SafePass mobile device or card.

Bank of America Routing Number California Texas New

Bank of America Routing Numbers and Wire Transfer Instructions

Wire Transfers Bank of Texas

Wire Transfer FAQs What is a Wire Transfer? Bank of America

Bank of America Wire Transfer – Wire Transfer

INTERNATIONAL WIRE TRANSFER FORM Indiana University

Bank of America Wire Transfer Instructions Pocketsense

https://en.wikipedia.org/wiki/CLABE

Wire Transfers America First Credit Union

– IBERIABANK Bank Routing Number Wire Transfer Instructions

WIRE TRANSFER INSTRUCTIONS American State Bank and Trust

Receiving Wire Transfers International Wire Transfers

WIRE TRANSFER INSTRUCTIONS

WIRE TRANSFER INSTRUCTIONS American State Bank and Trust

Liberty National Bank Wire Transfers

International Wire Transfer Form February 2014 INTERNATIONAL WIRE TRANSFER FORM The International Wire Transform is designed to collect banking information for disbursements made via wire transfer to foreign bank accounts. INTERNATIONAL WIRE TRANSFERS ONLY . Beneficiary * …

Please refer to the Miscellaneous Fee schedule disclosure for a complete list of wire transfer fees. Please note, the cutoff time for wire transfers is 4PM CT/ 5PM ET. Outgoing Wire Transfers. Your Private Banker or local branch will be happy to assist you with outgoing wire transfers. Outgoing wires must be received by the Wire Transfer

Nevada State Bank offers a convenient way for your business to transfer funds rapidly from one bank to another via computer transmission. Nevada State Bank wires are processed through the FEDLINE system. For more information on sending a wire, contact us online or visit your nearest branch.

Wire transfer is the fastest mode of receiving money in your Industrial and Commercial Bank of China (ICBC) account from abroad. You can receive money into your Industrial and Commercial Bank of China account from a foreign country via International wire transfer.

Online wire transfers can be made directly from a PC or mobile device, using an online payments platform. No need to make time-consuming visits to a bank or wire transfer operator. Payments can be made in all major currencies and many minor ones. Online wire transfers can be sent to or received from any country where there are correspondent banks.

Send Money Fast. We know that sometimes business can’t wait. Our Wire Transfers have been designed with the speed of your business in mind. We speed up collection and crediting procedures by transferring funds electronically on the same day you put in your request, …

Click for Incoming Wire instructions. Click for Outgoing Wire instructions. Wiring Fees. As a not-for-profit financial co-op, BECU returns profit to members in the form of better rates and fewer fees. Wire transfers are just one more product where BECU members enjoy the concept of “fewer fees” firsthand. And sure, while there is a fee to

ICICI Bank does not charge anything for Wire Transfers except for Service Tax on Foreign Currency Conversion. The remitting bank/correspondent bank may levy charges for the wire transfer. Goods and Service Tax will be levied on the converted gross INR amount in accordance to GST Bill 2017 passed by the Government of India w.e.f. July 1, 2017.

Bear in mind that the sending bank will need to receive the transfer order from the person holding the account. All the account holder needs to do is tell them the amount to send and give the bank the wire transfer instructions. Government Liquidation provides an example of instructions for wire transfers. Step. Be patient. Most banks execute

Incoming wire transfers are immediately credited to your account How To Send A Wire Transfer. To send a wire transfer, either visit an an America First branch location or call us at 1-800-999-3961. There is a fee for outgoing wire transfers. For details, please see the Bank to Bank Transfer fees in our Truth-in-Savings Rate and Fee Schedule.

Knowing the correct SWIFT/BIC code for Bank of America is essential for making international wire transfers to and from your Bank of America account. A SWIFT code consist of 8 or 11 letters that decode the name, country and sometimes the branch of the banks involved: AAAA – Bank Code (BOFA) BB – Country Code (US) CC – Location Code (3N or 6S)

Note of Caution on Fees: If your money transfer involves currency conversion, there is a high chance you will get a poor exchange rate from the banks and as a result pay high hidden fees.We recommend services like TransferWise for getting best conversion rates and lower wire transfer fees.. Outgoing International Wire Transfer Instructions. To send international wire transfer from your Bank of

Bank of China (China) Wire Transfer – Wire Transfer

Wire Transfers American Bank N.A.

Note of Caution on Fees: If your money transfer involves currency conversion, there is a high chance you will get a poor exchange rate from the banks and as a result pay high hidden fees.We recommend services like TransferWise for getting best conversion rates and lower wire transfer fees.. Outgoing International Wire Transfer Instructions. To send international wire transfer from your Bank of

No matter what bank you use, tracing a wire transfer will be a pretty similar process. Whether you sent your transfer from Bank of America, Wells Fargo or Chase Bank, you should be able to put a trace on it. You’ll need your reference number, and you might need an ID or some other way to verify it’s your wire transfer. The main thing that

Bear in mind that the sending bank will need to receive the transfer order from the person holding the account. All the account holder needs to do is tell them the amount to send and give the bank the wire transfer instructions. Government Liquidation provides an example of instructions for wire transfers. Step. Be patient. Most banks execute

Wire Transfer Instructions Use the following information to wire money TO your Liberty National Bank Account Liberty National Bank 118 S Main St, Ada OH 45810 ABA #041205929 For credit to: (your name and account number) For international wires: Please call or stop in …

Page 1 of 2 (See reverse side for more information.) Fast, convenient and secure wire transfers through Online Banking If you have questions or need help, call 800.933.6262. Make domestic and international wires right from your Bank of America® account1 • Wires submitted by 5 p.m. Eastern will go out the same day and generally be delivered in one business day

International Wire Transfer Form February 2014 INTERNATIONAL WIRE TRANSFER FORM The International Wire Transform is designed to collect banking information for disbursements made via wire transfer to foreign bank accounts. INTERNATIONAL WIRE TRANSFERS ONLY . Beneficiary * …

Incoming wire transfers are immediately credited to your account How To Send A Wire Transfer. To send a wire transfer, either visit an an America First branch location or call us at 1-800-999-3961. There is a fee for outgoing wire transfers. For details, please see the Bank to Bank Transfer fees in our Truth-in-Savings Rate and Fee Schedule.

Send Money Fast. We know that sometimes business can’t wait. Our Wire Transfers have been designed with the speed of your business in mind. We speed up collection and crediting procedures by transferring funds electronically on the same day you put in your request, …

Domestic and international wire transfers are deposited to your active U.S. Bank checking or savings account once they are processed by the Federal Reserve (domestic wires) or the Swift system (international wires). There is certain information the sender of the wire transfer will need to know in order for you to receive the funds:

Wire transfers are commonly used to send and receive money internationally. While the process is relatively simple for senders and recipients, international wire transfers are more complicated for the banks involved because they rely on a series of correspondent banking relationships between banks in different countries.

Speed of transfer: Wire transfer is the fastest possible way to transfer money from one account to other and most domestic wire transfer usually happen the same day.ACH transfers may take up to 3 days to complete. Cost of transfer: The speed of wire transfer comes at a price.A domestic wire transfer sending fees borders around for most banks. . Most banks even charge for incoming wire

Bank of America allows customers to send wire transfers across the U.S. and to more than 200 countries. There is the option of using the bank’s online platform, or visiting one of the local Bank of America financial centers. Be prepared to provide the recipient’s banking info, as well as your own.

Knowing the correct SWIFT/BIC code for Bank of America is essential for making international wire transfers to and from your Bank of America account. A SWIFT code consist of 8 or 11 letters that decode the name, country and sometimes the branch of the banks involved: AAAA – Bank Code (BOFA) BB – Country Code (US) CC – Location Code (3N or 6S)

Wire transfer is the fastest mode of receiving money in your Industrial and Commercial Bank of China (ICBC) account from abroad. You can receive money into your Industrial and Commercial Bank of China account from a foreign country via International wire transfer.

How to Receive an International Wire Transfer Sapling.com

Wire Transfers BECU

Whether you owe a friend or family member some money, or you simply want to move funds from one bank account to a Bank of America account, you can do so with ease. You can use the ATM, online banking, wire transfer or credit card to transfer money into a Bank of America account.

Knowing the correct SWIFT/BIC code for Bank of America is essential for making international wire transfers to and from your Bank of America account. A SWIFT code consist of 8 or 11 letters that decode the name, country and sometimes the branch of the banks involved: AAAA – Bank Code (BOFA) BB – Country Code (US) CC – Location Code (3N or 6S)

wire transfer instructions . wire instructions for money being wired into your account at american state bank & trust company . wire to: bankers bank of kansas . 555 n. woodlawn, bldg 5 . wichita, ks 67208 . aba number: 101104805 to the account of: american state bank & trust company, great nd kse account number: 0111494

For international wire transfers, in addition to our standard wire transfer fee, other fees may also apply, including those charged by the recipient’s financial institution, foreign taxes, and other fees that are part of the wire transfer process. Markups associated with the currency conversion are included in the Bank of America exchange rate.

Bank of Nevada gives your business a fast, convenient option to send and receive funds throughout the United States and internationally. Wire transfers can be initiated either through a business banking office or with just a few clicks online.

Bank of America international wire transfer fee: How much does it cost to send a wire transfer? The process for wiring money with Bank of America is fairly straightforward, but how much does it cost? Here’s a quick breakdown of what fees you can expect to pay when trying to wire money with Bank of America.

Bank of America allows customers to send wire transfers across the U.S. and to more than 200 countries. There is the option of using the bank’s online platform, or visiting one of the local Bank of America financial centers. Be prepared to provide the recipient’s banking info, as well as your own.

Wire Transfer Instructions Use the following information to wire money TO your Liberty National Bank Account Liberty National Bank 118 S Main St, Ada OH 45810 ABA #041205929 For credit to: (your name and account number) For international wires: Please call or stop in …

Incoming wire transfers are immediately credited to your account How To Send A Wire Transfer. To send a wire transfer, either visit an an America First branch location or call us at 1-800-999-3961. There is a fee for outgoing wire transfers. For details, please see the Bank to Bank Transfer fees in our Truth-in-Savings Rate and Fee Schedule.

Receiving Wire Transfers International Wire Transfers

Bank of America Routing Numbers and Wire Transfer Instructions

Bank of Washington personal and business customers may initiate a wire transfer by coming into any of our branches. Business customers have the opportunity to initiate wires online. Please contact us at 636-239-7831 or online@bankofwashington.com for more information on this service.

Incoming wire transfers are immediately credited to your account How To Send A Wire Transfer. To send a wire transfer, either visit an an America First branch location or call us at 1-800-999-3961. There is a fee for outgoing wire transfers. For details, please see the Bank to Bank Transfer fees in our Truth-in-Savings Rate and Fee Schedule.

Sending Wire Transfer From Bank of America Offline Process. For offline fund transfer to an International/Domestic account from your Bank of America account, you need to fill Wire Transfer Request Form which can be availed from any Bank of America branch. Complete all fields on this form as per Wire Transfer Instructions.

Bank of America allows customers to send wire transfers across the U.S. and to more than 200 countries. There is the option of using the bank’s online platform, or visiting one of the local Bank of America financial centers. Be prepared to provide the recipient’s banking info, as well as your own.

29/03/2019 · How to Make an International Wire Transfer. Wire transfers are a type of electronic funds transfer. They are usually considered the safest way to transfer funds, especially large amounts, to banks in countries overseas. Most large banks…

Domestic and international wire transfers are deposited to your active U.S. Bank checking or savings account once they are processed by the Federal Reserve (domestic wires) or the Swift system (international wires). There is certain information the sender of the wire transfer will need to know in order for you to receive the funds:

Note of Caution on Fees: If your money transfer involves currency conversion, there is a high chance you will get a poor exchange rate from the banks and as a result pay high hidden fees.We recommend services like TransferWise for getting best conversion rates and lower wire transfer fees.. Outgoing International Wire Transfer Instructions. To send international wire transfer from your Bank of

Wire Transfer Instructions . Funds can be transferred to and from your First Republic Bank account by wire transfer or via ACH (Automated Clearing House) debits or credits. To receive funds by wire transfer, please include the following information on your instructions to the originating institution: